Florida House Speaker Paul Renner answers questions about HB 1, which would expand education choice eligibility to all K-12 students and allow for customization. Photo courtesy of Florida House YouTube channel.

Editor's note: Last week, Florida House leaders announced the filing of HB 1, a landmark bill that would expand education choice and customization to all students in the state through the availability of education savings accounts. If passed, the bill would also allocate enough funding to aid all students currently waiting to be awarded ESAs through the Family Empowerment Scholarships for students with Unique Abilities program. Here are excerpts from House Speaker Paul Renner’s remarks at a news conference. You can watch the event in its entirety here.

As I reflect on the bill we file today, I’m reminded that every single child in this state and this nation grows up with dreams, and as we celebrate Martin Luther King this week, I’m reminded of his dream that every child would one day reach their full potential.

Today’s bill is about doing exactly that and making sure every child in Florida reaches their full potential educationally. And on a more fundamental level, it’s really about freedom and opportunity.

And so today, we empower parents and children to decide the education that fits their needs. And one of the things I’m most excited about is that we currently have a waitlist for children with unique abilities. And it is a tragic thing for a parent to have to say no to their children to have the resources they need in this situation…this bill will completely clear the waitlist for our children with unique abilities.

I think you’re going to see bipartisan for his bill. Maybe I’m going out on a limb, but I don’t think so. I think people realize more and more how powerful it can be. Look, every business, everywhere we shop, has an entrance and an exit except in our public schools, traditionally, where you have to go to the school wherever you’re zoned for and that’s it, whether that school meets your needs or doesn’t meet your needs.

And we have great public schools. There are many people looking to hit the entrance into public schools…. but every school, like every business, should have an entrance and exit. And if the schools are performing well, more people will hit the entrance. If they’re not, more people can hit the exits.

And this bill in a powerful way provides both an entrance and an exit to all of our schools so we can match people up in the best way possible.

And the ESA component to the bill allows choice within choice, so that you can truly get to the goal of customized education.

Even brothers and sisters learn differently. Some are good in math; some are good in English. And this allows, as we look toward the choice navigator, to give advice and counseling, not dictates, but advice on based on scores, based on what’s going on in that child’s life which the parent uniquely knows, to further enhance and customize that child’s experience so we get the maximum potential out of every single child in the state.

I grew up and went to traditional public school my entire time. I got a good education. My mother was a public-school teacher. Many people will stay right where they are because they’re happy. But this is really about making sure there is increased competition and always striving to do better.

Kaylee Tuck, daughter of Andy Tuck, a member of the Florida Transportation Commission who served as vice chair of the Florida State Board of Education, described herself as “the heartland conservative" and a pro-Trump, pro-gun, pro-life candidate in her successful bid to become a member of the Florida House of Representatives in 2020.

Editor’s note: This commentary from Republican Rep. Kaylee Tuck, who chairs the Florida House Subcommittee on Education Choice and Innovation, appeared Friday on foxnews.com

For years, school choice opponents in states like Iowa and Texas have gotten away with spreading myths about school choice to scare people in rural areas.

They’ve said school choice can’t work in rural areas because there aren’t enough private schools, and that all the money for choice scholarships will go to private schools in the cities. Then, at the same time, they’ve tried to argue that choice will wreck rural public schools and the rural communities that love and depend on them.

In Oklahoma this year, the Democratic candidate for governor even made it a pillar of her losing campaign to say school choice was a "rural school killer."

None of that is true. I know, because I’m a state lawmaker who represents one of the most rural areas in Florida, a state that’s been a school choice leader for 20 years.

School choice helped elevate Florida from being one of the worst education states in America to No. 3 in K-12 achievement. And every year, thousands of rural families experience the life-changing upside of having options.

I am privileged to represent four rural counties in a region called the Florida Heartland. We’re not the Florida they put on postcards. Cattle and citrus are some of our biggest industries, and the tourists we get tend to like racing (at Sebring International Raceway) and bass fishing (on Lake Okeechobee).

The people in my district are resourceful and hard-working, the kind who make rural communities the backbone of America.

They value school choice.

A decade ago, 390 students in my district used state-funded school choice scholarships or state-funded education savings accounts. Last year, more than 1,500 did.

Statewide over that same period, the number of choice scholarship students in Florida’s 30 rural counties grew from 2,547 to about 8,500, according to a new report from Step Up For Students, the nonprofit that administers Florida’s choice scholarships.

That’s a lot of rural families accessing options. But how did they find those options if supposedly there aren’t any private schools in rural areas?

There have always been private schools in rural areas, even if they tend to be fewer and smaller just like the public schools in rural areas. But supply has also grown to meet demand. Since school choice got rolling in Florida, the number of private schools in rural counties has nearly doubled. In my district, they’ve grown from 15 to 25.

Alane Academy in Wauchula, a town of 5,000 people in my district, is one of them. A former school district Teacher of the Year started the school a decade ago because she wanted more flexibility with everything from curriculum to scheduling to assessments.

What she created is top-notch – and a Godsend for families whose children were struggling in traditional schools. Nearly 70% of her students use choice scholarships.

"When you think of private schools coming into small towns, we’re not these big bad people, corporate organizations trying to come in and take over the school system," the founder said. The schools are started by "people just like myself, who grew up in that area, love that area, and just want to provide another choice."

Our community is stronger with schools like Alane Academy. And here’s the kicker: At the same time school choice has been helping thousands of rural families, it has not been undermining rural school districts.

In the past 10 years, the share of rural Florida students enrolled in private schools has risen 2.4 percentage points, to 6.9%. In my district, it’s gone from 4.7% to 7.3%. That’s it, even though more than 70% of Florida families are eligible for choice scholarships.

Across America, next year’s legislative sessions are just around the corner, and school choice opponents know choice has the momentum. They will double down on misinformation in an effort to stem the tide. But the facts on the ground show choice is a plus, including for rural areas.

Rural lawmakers should embrace choice. Rural families and communities will be even stronger when they do.

Kentucky Supreme Court Justice Lisabeth Hughes

Editor’s note: This article appeared Thursday on foxnews.com.

A controversial school choice program that would have provided dollar-for-dollar tax credits to those donating money for nonpublic school tuition is unconstitutional, the Kentucky Supreme Court ruled Thursday.

The program, blocked by lower court proceedings for more than a year, could have cost the state up to $25 million in its first year of implementation. Both individuals and corporations would have been able to write off up to $1 million on their state income taxes.

In a unanimous opinion, the court's seven justices cited a section of the Kentucky Constitution that prohibits the state from raising funds for nonpublic schools.

“Simply put,” the justices wrote, the school choice program “puts the Commonwealth in the business of raising 'sums ... for education other than in common (public) schools.'”

The court declined to speak to the intent of the 2021 law creating the tax credit program — namely, whether the goal of raising money for more children to have the choice of attending nonpublic schools is with or without merit, though the justices did cite precedent from a 1983 case:

“We cannot sell the people of Kentucky a mule and call it a horse, even if we believe the public needs a mule.”

“If the legislature thinks the people of Kentucky want this change, (it) should place the matter on the ballot,” the court wrote, citing Fannin v. Williams, the 1983 case that struck down the state's attempt to purchase textbooks for nonpublic school students.

Thursday's decision ends a lengthy legislative and legal process to make “education opportunity accounts” a reality in Kentucky.

To continue reading, click here.

Louise Janvier, center, applied for and received Florida Tax Credit Scholarships for her nephew, Guycelo Robert, and her daughter, Jahiara Jones.

MIAMI – Louise Janvier uses the word “environment” often when talking about education choice and how it can rescue a child.

“Sometimes, when a kid is going to go through things in life, they have to be in the right environment in order to pull through,” she said. “Some of them don’t pull through because they weren’t in the right environment and didn’t have the right support.”

As examples, Louise offers her daughter, Jahiara Jones, and her nephew, Guycelo Robert. Both found themselves surrounded by peers who were leading them away from the values they were taught at home. Both, Louise thought, where in danger of making decisions that could have a negative impact on their future.

They needed to be in the right environment.

With the help of a Florida Tax Credit Scholarship made possible by corporate donations to Step Up For Students, Jahiara and Guycelo were able to land in that environment at Greater Miami Academy (GMA), a pre-K through 12 private school not far from their Miami home.

“I’m grateful for it, because without it, I’d probably would not have been at GMA,” Jahiara said. “The school introduced me to many different opportunities and allowed me to develop more as a person.”

Guycelo, who graduated from GMA in 2020, graduated last spring from Miami Dade College as a member of the Dean’s List while carrying a 4.0 GPA. A computer science major, Guycelo is entering his first semester at Florida International University. He plans on a career in coding.

To continue reading, click here.

CREATE Conservatory celebrated the 101st day of school with a “101 Dalmatians” theme featuring lesson plans that tied the arts to historical happenings 101 years ago. Students made their own newspapers to show what they learned, soaking the papers in pans of tea to give them the look and feel of old newsprint. The school will move to the site of a former minigolf center after Thanksgiving.

Once in a great while, the hook for an article — that is, the thing that caught the journalist’s eye in the first place — winds up being the least compelling aspect of the entire story.

This does not mean that the hook in this case is any less cool. At a glance, what’s better than a private school in rural central Florida moving its campus seven miles to the site of the former Adventure Cove, a derelict miniature golf course?

Or that the school’s founder intends to preserve at least a couple of the holes for student recreation as well as on-campus festivals and fundraisers.

“You know, make a hole-in-one, win a car?” says Nicole Duslak, a former Orange County public school teacher and the dynamo founder behind CREATE Conservatory. Meaningful pause. Eyebrow raised. “Know anybody who’d like to donate a brand-new car?”

But it’s what CREATE does and has been doing with rousing success since opening to students in Leesburg (about an hour’s drive north of Disney World) in 2020 that steals this show: The K-8 nonprofit employs arts integration to teach STEM subjects. And it sounds like Leonardo da Vinci-level genius.

Ever get a song stuck in your head in an endless loop? Who hasn’t? Silly brains. But suppose instead of driving you batty, that annoying tune taught you the periodic table of the elements? Or the arrangement of bones in the human skeleton? Or the order of mathematic operations, so you no longer got stumped by your friends’ annoying what’s-the-answer posts?

“We hear a song at a wedding or in the elevator or a department store, and we pick it up without really trying,” Duslak said. “It’s still a part of us decades later. We all do that, so we’re teaching science that way, a way that it becomes part of our students.”

CREATE Conservatory founder Nicole Duslak, front, with parent Candi DeMers

It’s not just singing — although the idea of a school as a real-life musical has its charms. CREATE introduces concepts through crafts, art, model-building, clay-molding, dancing, script- and narrative-writing, drafting graphic novels, and acting … to name a few of the school’s arts-immersive activities.

CREATE’s curriculum can’t be bought off the rack or downloaded from a website. Instead, Duslak and her staff of five are constantly writing it, and rewriting it, drawing inspiration from “Schoolhouse Rock!,” the Saturday morning series of short videos that musically covered themes including grammar, science, mathematics, history, and civics. (Admit it: You’re humming “Conjunction Junction” right now.)

Creativity rules the academic day. State standards ensure rigor.

Terri Harper, a mental health counselor and Duslak’s longtime friend, sends sons Levi, 10, and Landon, 8, to CREATE on a Florida Tax Credit Scholarship and a Family Empowerment Scholarship for Students with Unique Abilities. Both are administered by Step Up For Students, which hosts this blog. She is amazed and gratified by the changes in both.

“My kids, who have never really been too into art,” she says, “now they’re asking for sketch books and sketching pencils and things like that, because they're discovering this whole different side of themselves. Wow. Yeah, it's great, it's really great.”

Kim Levine, a Leesburg-based partner with Core Legal Concepts — a graphic design shop for lawyers — became CREATE’s first corporate sponsor four years ago, well before the school opened its doors.

“She draws people in,” Levine says, "and I think that's great. Maybe the parents feel that, or the perspective parents, when they go on a tour, and they meet Nicky and hear her talk.

“She's got a ton of experience and assorted degrees, so she's got credibility, but she's so warm and loving, and she's so committed to this idea.”

Meeting Duslak and a few of her key allies for the first time at a reception designed to recruit community and corporate support (Levine was the only visitor), it wasn’t long before Levine felt like a billionaire panelist on “Shark Tank” blown away by the contestant’s pitch. “I love this idea,” she said. “Let’s do something together.”

That something became two full scholarships, worth about $6,500 each — one named for Stuart Levine, Kim’s late husband — and graphic arts support from Core Legal.

“One of the first things I thought was, I wish I'd had the school when I was a kid,” Levine says, “because I needed that sort of simulation. … Yeah, I just love it. I just thought,” This is perfect, I want to be involved.”

Duslak’s methods may sound exotic. They certainly are mold-busting. But wait.

“The modern education system has told our bravest and most creative thinkers to sit down and be quiet,” Duslak said. “And that's problematic, right? … I don’t want to sit still for eight hours a day in a desk, and I’m a fully grown adult who has complete control over my functioning.”

CREATE students do not sit at desks. Because there are no desks. Instead, there are beanbags and bounce-on exercise balls and couches and ample floor space. And windows. Oh, so many windows.

“Occasionally,” Duslak said, “I'll have a kid out to go over and just stand and look out the window, and I'll think, ‘There is no way they have any clue what's going on right now.’ Then I'll call on them and they're right with me; they just have to move to think. … They just have to look at something else.”

This is no free-for-all, Duslak said. “It's just about fostering an environment where kids can be themselves and we can honor everything about them that makes them, them.

“We have a lot of structure. … It's about slow down and get to know them and appreciate them for who they are as people.”

If a chef’s proof is in the pudding, an educator’s proof is in the testing. And the CREATE Conservatory students are crushing it: Youngsters have arrived testing nearly two years behind grade level on the Iowa Test of Basic Skills and finished their first academic year testing three years above grade level.

Area parents are taking note. From seven students when CREATE opened to 28 and a waiting list in two years is the stuff of dreams-in-the-making.

So, about the miniature golf course, the conversion and partial preservation of which brought Duslak to our attention. It’s not

CREATE Conservatory student Amalie Weaver

exactly like a shut-down putt-putt course screams, Put a school here! There are bridges and boulders shaped from concrete, after all. And streams and a jungle temple that once had a waterfall running through it and a downed airplane stuck in one corner.

Those are a lot of attractive nuisances to demolish and haul away, at substantial expense, even with teams of volunteers swinging sledge hammers and loading wheelbarrows — $16,000 for the temple and airplane alone.

But Duslak had a best friend in her brother, David Slocum, a resort golf club professional who was working toward PGA status when he died in 2002.

“David has been and continues to be a huge motivator in my life, even though he's not here anymore,” Duslak said. “So, when we found this property and when all this came to be, I just sort of felt like that was his way of being involved in the process.”

Preserving a hole or two will honor both Slocum and the happy memories of Adventure Cove nostalgics. “It’ll be sort of an homage to what the property was,” Duslak says.

The 2.5 acres will be nice for Duslak’s long-range plans. She hopes to add a high school, and a theater for performing arts. For the moment, however, she’s happy to be moving into the attractive Key West-style two-story bungalow that once housed the business’ offices, storage, and concessions. The plan is to be fully relocated after Thanksgiving break.

The going, just now, is financially difficult, as the early days often are for many startups and pioneering entrepreneurs. But Duslak is dug in.

“I will be the greeter person at Walmart on my nights and weekends, if that's what I have to do,” she said, “because I will not let this fail.”

That’s the best hook of all.

Trinity Christian Academy in Lexington, Kentucky, is one of 351 private schools in the state serving more than 67,000 students. Trinity Christian prides itself on its Christ-centered classical curriculum and a low student-to-teacher ratio, existing to provide an “excellent classical education for the glory of Christ and the good of the Bluegrass.”

Editor’s note: This commentary appeared Thursday on courier-journal.com.

Two major educational events took place over the past week. First, the Kentucky Supreme Court heard oral arguments in the lawsuit seeking to block educational choice in Kentucky.

And, the Kentucky Department of Education released standardized test scores for Kentucky public schools from spring 2022. As expected, they reflect a staggering decline in core subjects like reading and math.

Both news events illustrate the urgency for expanding education options in Kentucky.

The issue before the Kentucky Supreme Court is whether the Education Opportunity Account Act is permissible under the state constitution. The EOA Act encourages private donations to nonprofit scholarship programs to help families with educational expenses, ranging from textbooks, technology and tutoring to private school tuition.

Donors who give to the program receive a state tax credit in return for their contribution.

Opponents claim this is the same as spending public dollars on nonpublic schools. But tax credit funded educational choice programs have been on the books for decades in other states.

From the U.S. Supreme Court down to every state supreme court that has heard a similar challenge, no lawsuit seeking to strike down a tax credit funded educational choice program has ever succeeded.

To continue reading, click here.

Cottonwood Day School in Bozeman, Montana, is one of 114 private schools in the state serving nearly 11,000 students. Cottonwood is specially designed to meet the unique needs of its students with special attention given to sound attenuation, colors, and lighting.

Editor’s note: This commentary from Montana Rep. Seth Berglee and Sue Vinto, Majority Leader and a member of the Montana House Education Committee, appeared Wednesday on flatheadbeacon.com.

The start of the 2022-23 school year marks the dawn of new educational opportunities for students across Montana.

The Tax Credits for Qualified Education Contributions Program will send its largest ever number of scholarship recipients to high-quality K-12 nonpublic schools this fall. For these students, the start of this school year represents a new beginning – a new chance to succeed academically and pursue their dreams.

We are thrilled for these students, and we cannot wait to see what they accomplish. But as state legislators who believe strongly that every Montana student deserves an education that fits his or her unique needs, we also know there is still much work to do.

Like many other states, Montana’s scholarship program works entirely thanks to private contributions from businesses and individuals to state-approved, nonprofit student scholarship organizations. Individual or corporate taxpayers who contribute to these organizations receive a dollar-for-dollar state tax credit for their gift, providing a strong incentive for them to support educational opportunities for disadvantaged students.

Those donations are then used to fund K-12 nonpublic school scholarships for students, usually prioritized on the basis of economic need. For instance, ACE Scholarships, the largest SSO in Montana, provides scholarships to students from families with income levels at or below 250% of the federal poverty guidelines, or about $69,000 for a family of four.

Until recently, the program was hobbled by unnecessary restrictions. For instance, the law restricted donors from contributing more than $150 dollars per year. Considering that average tuition in a Montana nonpublic school is between $6,000 and $8,000 per year, it would take about 50 donors to fully fund one student’s tuition payments—although even doing that was impossible, as the program capped scholarship values far below the actual cost to educate a child.

To continue reading, click here.

Care.com, a website that provides information for families about childcare programs, states that Kids Palace in Hialeah, Florida, “works with parents in giving the best care that is comfortable and enjoyable for students.”

The former owner of a South Florida daycare recently was sentenced to prison for committing fraud against the Florida Tax Credit Scholarship.

Lissette Orta, the owner of Kids Palace Daycare in Hialeah, was sentenced Sept. 9 to 21 months behind bars after being found guilty of committing more than $100,000 worth of fraud during the 2016-17 school year. Orta was arrested in 2019 after an investigation by the Florida Department of Education and Florida Department of Law Enforcement revealed she had submitted applications on behalf of parents, claiming their children were attending the school full-time.

Orta was charged with stealing $130,249 in scholarship money intended for low-income students. State records show Kids Palace Day Care was voluntarily dissolved in October 2017.

According to the FLDOE annual accountability report, fraud against the scholarship program is exceedingly rare. Last year, more than 2,000 private schools participated in scholarship programs with only three cases of fraudulent activity detected in 2021.

Over the last decade, FLDOE revoked 43 schools from being able to accept scholarship funds due to fraudulent activities. Another 21 schools entered into settlement agreements with the state.

State rules require all new schools accepting scholarship programs to receive a site visit from FLDOE. Schools must have a surety bond and complete a financial report with a certified CPA if the school receives more than $250,000 a year in scholarships.

Financial reporting requirements were revised and strengthened in September 2018 and March 2020, making it easier for FLDOE to catch fraud and suspend or revoke schools.

Eleventh Circuit Court Judge Teresa Mary Pooler imposed a civil lien of $130,249 on Orta earlier this month. Orta is to repay Step Up For Students, which had raised the funds from private corporate contributions.

Step Up For Students (which hosts this blog) is one of two scholarship funding organizations in Florida. The nonprofit raised private corporate donations as part of the Florida Tax Credit Scholarship program for low-income and working-class students. Corporations receive a dollar-for-dollar tax credit for their contribution to the scholarship program.

So far, Step Up For Students has funded 85,539 students on the Florida Tax Credit Scholarship program for the 2022-23 school year. The average student lives in a household earning less than $41,000 a year. More than half of the students come from a single-parent household, and 67% are Black or Hispanic.

The Florida Tax Credit Scholarship program has a more than two-decade history of educating the least-privileged and most-struggling students in the state. More than a decade’s worth of research has shown that scholarship students, despite their challenges, keep pace with the educational attainment of all students nationwide.

A new report from the Florida Policy Institute takes aim at the Florida Tax Credit Scholarship, which from its inception in 2001 has aimed to expand educational opportunities for children of families with limited financial resources to enable those children to achieve a greater level of excellence in their education.

The author of "Silent Spending, Florida’s Shadow Budget Needs Greater Scrutiny,” wants to improve tax equity and increase government revenue by eliminating up to $23 billion in “tax expenditures,” including the scholarship.

But “tax expenditures,” or what the report calls “silent spending,” isn’t government spending at all. It’s simply an accounting of revenue not collected by government through tax credits, tax deductions and tax exemptions.

Tax credits targeted by the Florida Policy Institute include the Florida Tax Credit, which last year provided scholarships to 86,726 low- and middle-income students, 73% of whom are non-white.

“The question remains as to whether revenue that would otherwise be used for general public purposes ought to finance private school education,” writes the author.

Set aside the fact that the question is largely settled: Scholarship opponents have been defeated in court three times in the last decade; the scholarship has been in law for 21 years; and the program has provided more than 1 million scholarships to low- and middle-income students, most of whom are children of color.

Contrary to Florida Policy Institute’s assertion, the Florida Tax Credit Scholarship does provide “a general public purpose,” that being the education of students. Whether that education occurs in a private school or a public one, the benefit to the general public (an educated populace) remains the same.

Furthermore, while the elimination of the FTC would increase government revenues, it would also cost the state double what it gained. This year, scholarships average between $7,250 and $7,850, depending on the student’s grade and county of residence. Florida’s local school districts spend more than double that per pupil from all revenue sources.

The institute makes the case that eliminating these tax expenditures would increase government revenue and allow government to spend the additional revenue improving the public good.

“It is uncertain if sacrificing $23.6 billion leads to more socially desirable outcomes than simply collecting the forgone amount and financing better-quality public schools, safe and affordable housing, reliable transportation infrastructure, clean water and energy and robust safety,” the report states.

However, it is equally uncertain that eliminating these “tax expenditures” would improve anything.

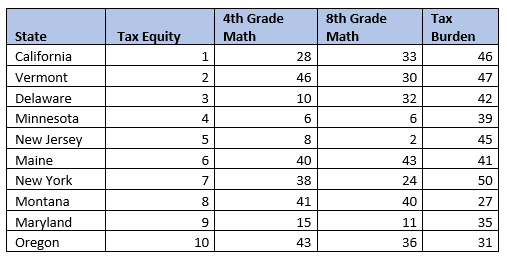

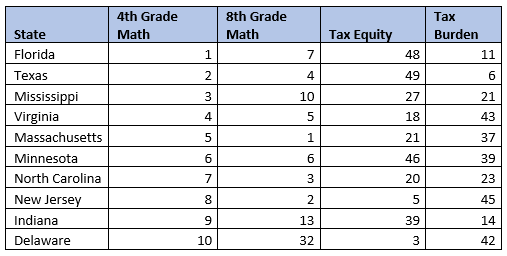

High tax equity appears to have no relation to educational outcomes as measured by the National Assessment of Education progress. Using the Urban Institute’s educational rankings, which adjust for race and income to provide an apples-to-apples comparison across states, we see that high equity states don’t necessarily come with strong education systems.

They do, however, tend to come with high tax burdens as measured by the Tax Foundation. Tax equity may lead to lower-income taxpayers paying less as a percentage of their total income relative to higher earners, but it doesn’t mean their total tax burden is less. In fact, it may be higher.

Worse still, you may end up paying higher taxes for lower quality services. See California, Vermont and New York in the chart above. In contrast, Florida ranks 48th in Tax Equity but has a relatively low overall tax burden for taxpayers.

Meanwhile, Florida ranks first in fourth-grade math and seventh in eighth-grade math on the National Assessment of Educational Progress. Texas too, scores poorly on tax equity, but places sixth for lowest tax burden and second in fourth-grade math and fourth in eighth-grade math.

If you were a low-income parent of color, would you rather live in Florida, with lower tax equity but higher educational outcomes for your child, or California, with higher tax equity but lower educational outcomes and a potentially higher tax burden?

The scholarship program has a more than two-decade history of educating the least-privileged and most-struggling students in the state. More than a decade’s worth of research has shown that scholarship students, despite their challenges, keep pace with the educational attainment of all students nationwide.

Additional research by the Urban Institute shows that scholarship students were up to 99% more likely to attend college and up to 45% more likely to earn a bachelor’s degree than their public school counterparts.

While there are tax credits, deductions and exemptions that should get additional scrutiny as to whether they are unfair or fail to provide public benefits, the Florida Tax Credit Scholarship is not one of them.

Editor’s note: This commentary from Tim Benson, a policy analyst in the government relations department of the Heartland Institute, appeared recently on the institute’s website.

Editor’s note: This commentary from Tim Benson, a policy analyst in the government relations department of the Heartland Institute, appeared recently on the institute’s website.

A January 2022 white paper from the Pioneer Institute illustrates how a tax-credit funded education savings account program might be the best way forward for pursuing educational reform in Massachusetts.

In Modeling an Education Savings Account for Massachusetts, Pioneer Institute senior fellow Cara Candal argues this type of ESA could possibly make its way around the commonwealth’s incredibly strict anti-Catholic Blaine amendment. The amendment currently bars public funding of faith-based schools, and which was not affected by the U.S. Supreme Court’s 2020 ruling in Espinoza v. Montana Department of Revenue overturning many of these relics of 19th century prejudice.

The Bay State’s Blaine amendment reads:

“No grant, appropriation or use of public money or property or loan of credit shall be made or authorized by the Commonwealth or any political subdivision thereof for the purpose of founding, maintaining or aiding any infirmary, hospital, institution, primary or secondary school, or charitable or religious undertaking which is not publicly owned and under the exclusive control, order and supervision of public officers or public agents authorized by the Commonwealth or federal authority or both.”

The workaround would be to fund the ESA as if it were a tax-credit scholarship program. Tax-credit scholarship programs allow individuals and businesses to contribute to a non-profit scholarship-granting organization which handles the funds. In return, individuals and businesses would receive a tax credit from the commonwealth that usually matches their contribution dollar-for-dollar.

These donations, not commonwealth funds, would then be used to provide ESA scholarships to families that meet the eligibility requirements and apply for them.

To continue reading, click here.